Why Have My Medicaid Rebate Payments and Processing Load Seen Such a Sharp Increase?

A look at Medicaid enrollment and what the future may hold.

The High Level Story

The old adage “Those who choose to ignore history are doomed to repeat it” certainly holds true with what we have experienced in the United States and across the globe during 2020 and 2021. While the catalyst may have changed, the resulting impact over the past two years on our national Medicaid system are trends we have seen before.

The current COVID 19 Pandemic and actions taken in an effort to address it at the state and federal level have caused dramatic increases to the number of Medicaid beneficiaries in every single state in the USA.

Additionally, remote work has created additional logistics challenges. State agencies responsible for invoicing for rebate liability then reconciling payments for the Medicaid Drug Rebate Program (MDRP) have challenges managing through the intense quarterly workload bubbles during the best of times.

The Pandemic has been particularly troublesome because the chaos related to employees of hundreds of agencies and entities needing to transition to working remotely.

Invoicing for prior quarter adjustments is at an all-time high. From our perspective it appears this is due to:

- Programs backdating eligibility of beneficiaries

- Utilization reporting delays across the entire supply chain and retail delivery system

- US postal services delays due to labor shortage continues to impact invoice deliveries and return payments

- Invoice reconciliations and payments received from Pharma Manufacturers or their outsourced partners sitting in backlog at the local Medicaid Program level are not accounted for prior to the next quarter’s rebate invoices are generated and distributed. This then requires additional processing activity due to the prior quarter adjustment invoices included in the packets. Some justified, some not.

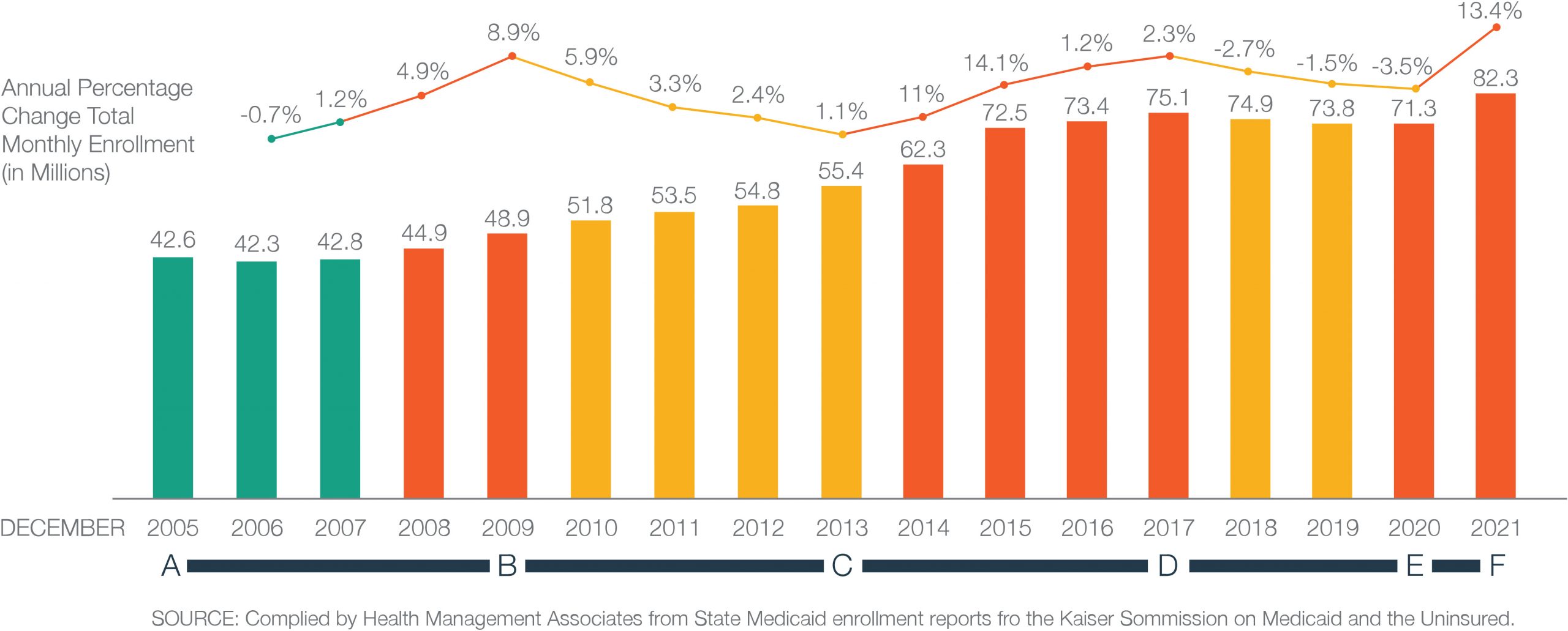

The impact of economic conditions and government policies is pretty apparent in the following diagram. (Fig. 1)

Point A to B – Coming into the economic crash of 2008 unemployment rates increased causing an increase in overall Medicaid Enrollment

Point B to C – During a period of economic recovery, lower unemployment drove a decrease in Medicaid enrollment

Point C to D – The Affordable Care Act (ACA) reduced eligibility requirements and increased federal funds to most states. The result was an increase in the number of Medicaid Programs across the country causing a broadened pathway for new Medicaid enrollees.

Point D to E – Historic reductions in unemployment rates across the country between 2018 and 2020 caused a reduction in overall Medicaid beneficiaries

Point E to F – The COVID-19 Pandemic by shuttered the economy, and in an effort to offset this burden the government moved money into the economy in the form of stimulus checks and historic levels of federal unemployment subsidies. People couldn’t work and the Medicaid Enrollment saw dramatic increases in all states. It is likely even higher than depicted in 2021 in the graphic since data is only reported thus far through April of 2021.

Figure 1: Annual Change in Total Medicaid Enrollment, December 2005 to December 2021

Increases to Medicaid rebate liability experienced by pharmaceutical manufacturers participating in the Medicaid Drug Rebate Program (MDRP) with the launch of the Affordable Care Act (AKA Obamacare or the ACA), the dramatic increases in unemployment in 2020 and 2021caused by historic levels of dollars pushed into the economy in the form of unemployment benefits and Pandemic related stimulus money have caused the Medicaid population to sharply rise once again. Tens of millions of Americans are finding a financial advantage from living off of government relief dollars over their prior earned income.

Medicaid enrollment Increases and corresponding increases in MDRP Rebate liability should be expected to continue for some time. As government policies, and mandates related to COVID 19 impact employment levels.

The year prior to ACA enactment, Medicaid enrollment grew by its slowest rate since the Great Recession in 2009. (Fig.2)

Policies and Economics Drive Medicaid Enrollment Numbers – More Detail

The pandemic and ACA enactment are two reasons Medicaid now covers nearly one in four Americans. Other factors, such as government policy, also influence enrollment.

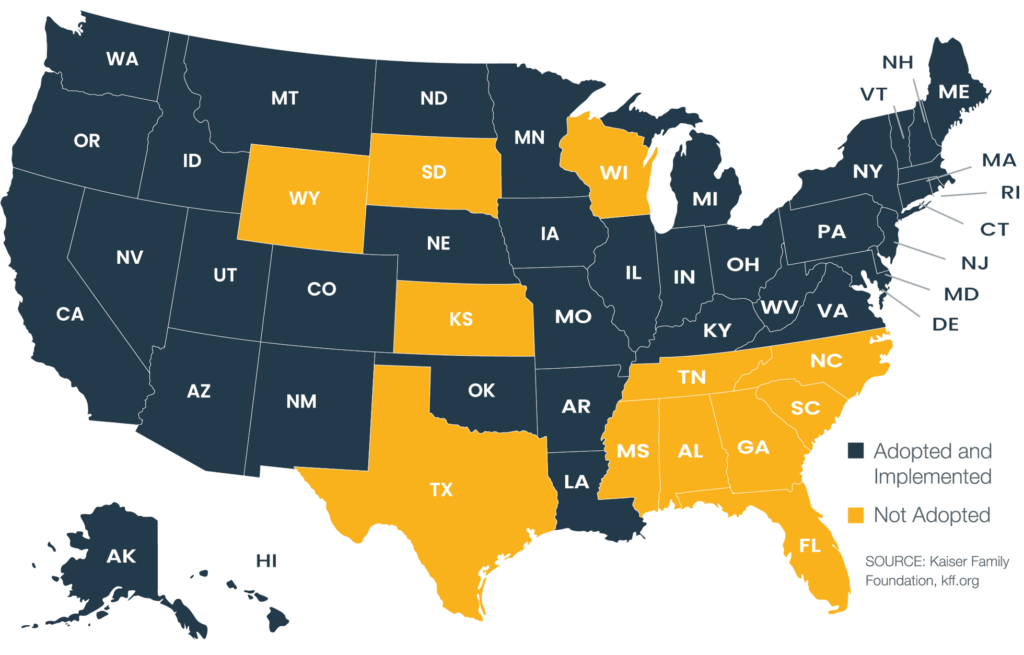

In 2012, the Supreme Court made state Medicaid expansion voluntary. Soon after, several states expanded, and 2013 brought the greatest increase in enrollment. So far, 38 states and the District of Columbia have adopted Medicaid expansion. (Fig. 2)

Figure 2: Status of State Action on the Medicaid Expansion Decision

The federal government is working on encouraging the remaining 12 states to adopt expansion. As an example, the March 2021 American Rescue Plan Act included incentives for the 12 holdouts (Read more about potential impacts of this Act).

Assuming the 12 states do not adopt, we likely will see more attempts to expand Medicaid in other ways, such as a recently introduced bill that seeks to enable local jurisdiction. This bill would give power to counties and cities to expand Medicaid. Separately, there’s also an idea being floated to increase expansion by amending the ACA.

Should any of these ideas – or future ideas – succeed, Medicaid enrollment would likely increase.

Unemployment and Medicaid Enrollment

The unemployment rate, unemployment insurance claims, and the employment-to-population ratio are indicators of Medicaid enrollment because they signal income loss. If the unemployment rate or unemployment insurance claims are high, chances are more people will enroll in Medicaid.

The August 2021 jobs report showed a lower-than-expected increase in job creation, while the unemployment rate drop – from 5.4 percent to 5.2 percent – was in line with what economists expected. The lower unemployment rate is one part of what contributes to Medicaid enrollment over time. However, you might not see a difference right away; and changes in enrollment don’t necessarily keep pace with the unemployment rate or number of unemployment insurance claims.

Because it’s so difficult to forecast the unemployment rate, you can’t effectively use this metric to plan too far ahead. As is stands today, the Federal Reserve projects the U.S. unemployment rate by the end of 2021 will be 4.5 percent and drop to 3.5 percent by 2023. This suggests that unemployment will not drive higher Medicaid enrollment over the next two years. Yet, it is expected Medicaid enrollment will continue to expand. Why?

Demographics and Medicaid Enrollment

Demographics also influence enrollment. (Consider “Expansion adults,” defined as adults made newly eligible for Medicaid under the ACA). Recently, they were the fastest-growing segment of enrollees.

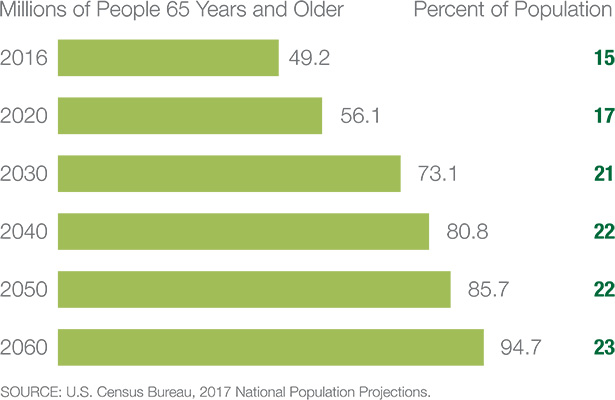

Over the next decade, the fastest-growing enrollment demographic will likely be the elderly. (Fig. 3) The U.S. Census Bureau projects that by the year 2030, 21%of the population will be elderly, defined as 65 years of age and older. That’s an annual increase of about 2.9%.

Figure 3: Projections of the Older Adult Population 2020 to 2060

By 2060, nearly one in four Americans is projected to be an older adult.

Faster growth in the higher-need segment of the elderly population will add fuel to expansion. Medicaid is likely to become a $1 trillion program in five years. To offer some perspective, Medicaid was a $577 billion program in 2017. In short, the numbers suggest enrollment will continue to increase, driven in part by demographics.

How Should Pharmaceutical Manufacturers React?

Government Pricing and Medicaid Enrollment

Of all government pricing programs, Medicaid demands the greatest resources. Monthly and quarterly AMP calculations to CMS, as well as separate submissions required by some states, are part of the highly complex government pricing requirements.

Simply put, when Medicaid enrollment expands along with the number of programs providing benefits, pharmaceutical workload seems to expand exponentially. You have more invoices to process and pay, along with more complex data sets to manage.

It’s not uncommon for drug manufacturers, overwhelmed and under-resourced, to miss a transaction-level detail and skew government pricing computations into the millions of dollars. Underpayment and overpayment of government rebates can result in significant losses.

Overpayment hits your bottom immediately and even after catching the problem can take many months, quarters, or even years to recoup the dollars through credits against current rebate liability. We regularly uncover errors during onboarding audits of new client historic computations, including one that totaled over $4 million. Underpayment results in immediate need for cash to cover the deficit. On top of that, there’s a high potential for penalties and interest charges.

Managing through increased risk

Considering the factors that can drive Medicaid expansion, at present it appears the best-case scenario for enrollment numbers in the coming years is a flatlining of growth.

Given the current issues with staffing and what is sure to be long term dramatic increases in the cost of skilled technical employees, you may want to consider an outsourcing solution since:

- Government pricing is complex.

- Medicaid enrollment is likely to continue to rise.

- Rebate reconciliation comes in quarterly waves, making it a challenge to staff for the fluctuating workload.

- Limited internal resources are best focused on company profitability and growth objectives.

Mark Patton

Chief Executive Officer

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy