Avoiding Costly Government Pricing Mistakes

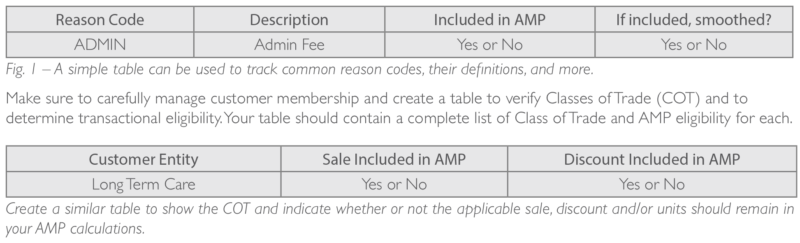

The first step within your SOP should outline the data you will gather, how you will gather it and how you’ll analyze it. The devil is in the details. Make sure you understand the various credit types, as well as what’s included and excluded. Remember chargebacks, discounts, administrative fees, rebates and miscellaneous items. Consider creating a table to track your work (Fig. 1).

3. Compute AMP and Other Required Values

Once you have analyzed and scrubbed relevant sales data and determined transactional eligibility, input the information into your government pricing calculator.

The method used to calculate liability matters. Some pharmaceutical companies, or their external analysts, use system-based GP calculations. We

encourage you to adopt a robust Excel spreadsheet or Access database for maximum report transparency. System-based GP calculations can often leave you in the dark when seeking to understand the minutia of the calculation. You want to be able to see the influence sales data or systemic data variations can have on government pricing values. This becomes nearly impossible if you rely on system-based computations that may hide some or all the granularity.

Seeing report detail helps you better understand your customers, contracts and pricing for each product. You can make smarter decisions about the factors that affect your company’s growth and profitability. Without full transparency and careful analysis, you’re left with, at best, a limited understanding of the underlying data and the powerful insights it can reveal.

Finally, apply required smoothing and compute 12-month rolling AMP. The last column in Fig.1 references smoothing, which calculates data at their rolling averages. Imagine for example that you had $1MM in chargebacks applicable to AMP for one month. You launch a new product or gain new customers and now have $10MM in chargebacks. Yet, your actual sales the month prior – due to wholesalers stocking product – were only $5MM. This negative value gets smoothed out by taking your 12-month rolling average. Understanding the rolling-average methodology will help prevent miscalculations.

When analyzing your rebate, credit and chargeback data over the last 12 months, take your rolling average, then apply that ratio to today’s sales. Rolling average is vital for current and future calculations. A missed detail at this step could quickly escalate into a costly error. Inaccurately calculating a single month will affect 11 months going forward.

Although the methodology outlined here references AMP calculations, a similar approach can be used for other calculations you may need to perform.

- Best Price applies to single source, or innovator drugs. It’s the lowest price at which the product is sold during a calendar quarter, regardless of package size. It’s a component of the Unit Rebate Amount (URA) that derives from the AMP. Best Price gets calculated from data obtained through various sources and calculations, and it excludes several transactions incorporated into AMP.

- NonFAMP calculations, for Veterans Administration contracting, are similar to AMP.

- ASP reporting is the Average Selling Price. A calculation like AMP, it’s used for Medicare. ASP sets the reimbursement rate for physician-administered drugs, such as injectables.

4. Perform an Internal Audit – Review Your AMP Computations

As you review your numbers in their entirety, look for fluctuations and variances from previous months. When found, determine why those changes occurred and whether they need to be addressed more closely. Sometimes, differences are simply anomalies that can be easily explained.

While math is black and white, understanding what the numbers imply is

altogether different. Good analysts recognize when to dig deeper, dissect data, isolate what’s relevant, and evaluate and clean the underlying data. Great analysts have developed an analytical sixth sense. They know where to look for data problems and engineer process improvements to ensure clean datasets are driving computations.

Once you have confidence in your monthly computations you can pull it all together and perform quarterly AMP calculations. These will drive your rebates. Determine your quarterly AMP by taking the sum of net sales for your three calculated months and divide that value by the sum of your three calculated months’ net units. Have your calculations certified by the appropriate person at your company.

5. Ensure Product Access

Although this really is not related specifically to your government pricing work, surprisingly, it is often overlooked. Ensure your products are accessible to patients by providing your information to data sources that make it available to pharmacy databases. All of your AMP efforts will be wasted if patients do not have access to your products through their insurance provider.

List with the Centers for Medicare & Medicaid Services (CMS) database and all major pricing compendia. Follow up afterward with these data sources to ensure your product has been properly listed, and troubleshoot potential coverage issues to prevent big headaches down the road. Conduct listings throughout your product’s lifecycle and properly report discontinued or recalled product listings to CMS.

Finally, pay rebates that come in from the states. Communicate with states as often as needed to ensure timely, accurate rebate payments. Do not be surprised if issues arise that you will want to dispute.

6. Stay Diligent

In 2016, CMS released the AMP Final Rule, which provided the regulatory definition for AMP and refined how pharmaceutical companies must calculate their Medicaid drug rebates. AMP was first passed into law in 2005, followed by an immediate court challenge. Since that time, we have seen controversies and inconsistencies involving manufacturers.

The only certainty about GP may be continued change. Whether due to efforts to manage costs at the patient level – or reform healthcare altogether – GP rules and guidelines will keep evolving, as will the interpretations of the existing ruleset.

While it’s challenging to stay up to date on regulatory changes, the greater concern is how to manage GP relative to your overall business strategy.

If you have questions about your GP computations and how GP influences business strategy, call us or email your questions to info@prescriptionanalytics.com. We’re here to help you achieve your business objectives.

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy