Factors to Consider When Acquiring and Launching A Previously Marketed Pharmaceutical

Contemplating Acquiring An Existing Product?

Be Sure to Do Your Homework!

Any pharmaceutical manufacturer who has launched a new prescription drug understands the enormity of such an endeavor. It requires a great deal of focus, time, effort, and coordination for the launch to be successful. Failure to build a detailed plan and follow it in a disciplined fashion for every product launch is a prescription for disaster. If your company is acquiring a previously marketed product there are additional dynamics that that need to be explored and considered in the acquisition negotiations and commercialization planning process.

When launching a previously marketed NDA or ANDA, several important factors must be reviewed, analyzed and adopted in the decision-making process. Overlooking any of these can result in a major impact on anticipated growth and profitability goals a pharmaceutical company would hope a new product launch should afford.

Evaluate the product viability and sustainability including what barriers of entry exist and the current market landscape.

- Are there competing products with tentative approvals coming sooner than initially anticipated? Competitor products coming to market could mean a smaller market share cap for your product and consistent reductions in margins, or create challenges that require different marketing solutions than initially planned.

- How stable is the supply line now? What is anticipated for the future? Difficulty supplying a drug in the market can be both a challenge and an opportunity. At certain times, even large market players have difficulty supplying certain drugs to key customers. If you can step in and fill that void it can be an opportunity for your company. However, if the product’s supply line looks unstable for your organization, this can present additional risk and can even result in monetary penalties by customers if you enter into agreements that you can’t fulfill completely. It is important to consider all aspects of your own manufacturing and supply line to ensure that the structure you have in place is sustainable and reliable.

- Is the Active Pharmaceutical Ingredient (API) readily available without undo cause for concern, allocated supply, or limited supply? If the API is difficult to acquire and/or manufacture, this can limit competition. If that is the case, can your current partners/facilities deliver as promised?

Understand the product’s history.

Understand the product’s history.

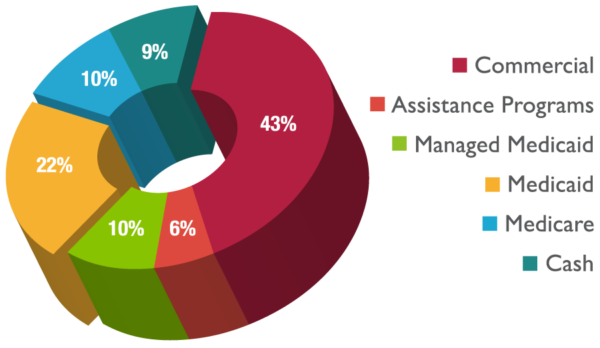

- Have a good understanding of your customer utilization, rebate liability by segment, and customer or payer mix. Understanding these dynamics is critical for focusing your contracting and marketing efforts.

- During an acquisition, will there be existing inventory under a different manufacturer or labeler? If so, what is already in the various distribution channels versus work-in-process? Knowing this and the expiration dates could identify a myriad of returns that may need to be negotiated before the acquisition.

- Discuss and identify key cutoff dates with any other parties to determine who will pay rebates and for how long. If you are acquiring an entire labeler code, liabilities will continue to follow any associated products for years. It is not uncommon to get adjusted Medicaid invoices for multiple years following the initial dispensed date of a product. Who is going to be responsible and how will this be structured? If you don’t know, you may end up incurring additional liability for which you have not planned and accrued dollars, as CMS will hold the current owner of that NDC or labeler code responsible for payment.

- Ensure there are no pre-existing debts, recalls, lawsuits or penalties. If there are, who will pay and how will they impact the future commercial viability of the product?

- Explore the multitude of State Price and Financial Disclosure Reporting requirements. Have all reporting requirements in the past been completed on a timely basis and satisfied with each state requiring reporting and notifications? Are there any fines or penalties from prior periods that were not reported or reported incorrectly? The penalties and fines can be severe and are NDC-specific. State regulators will expect someone to pay for penalties, so it is vital to understand the current landscape and plan accordingly. To remain compliant the launch price will need a review if it is changed or newly set to determine if any reporting is necessary. (Read our recent white paper on this subject here.)

Dig into the contracts.

- Unfavorable pricing on a contract may need to continue. Unfortunately, this could impact Best Price on the Government side, further compounding the negative impact on your bottom line. Sometimes simply terminating a contract or price could harm the customer or relationship. The business and revenue could be lost for months, years, or even indefinitely. Assessing the impact of keeping or losing an agreement will have lasting effects on the lifecycle of a product or pharmaceutical company.

- What current commercial agreements exist and what are their terms? Have any penalty triggers such as price protection been hit? Would you realize any real benefits from these agreements? Will these carry over with an acquisition of a product or will you be responsible for contracting with these entities? If there is large commercial utilization on a product, payers may be expecting a rebate on all utilization, and if you don’t have a contract with them, you could be excluded from their formulary.

- Has the product been subject to a CMS MDRP Agreement? If an NDA/ANDA was previously marketed and a Baseline AMP was established on a Medicaid Drug Rebate Agreement, this could result in additional rebate liabilities. Find out how understanding Baseline AMP rules can help you avoid pricing decision disasters.

- Has this product been covered by the Public Health Service (PHS/Section 340B)? Like the Medicaid Drug Rebate Agreement, there is potential to have a less than favorable PHS price that could evenly result or lead to “penny pricing.” This scenario essentially results in manufacturers giving away their products to covered entities.

- Is the product covered by the Veterans Affairs/Federal Supply Schedule? This contract may offer some leniency in the first full year of a product acquisition; however, be mindful to any inherent pricing and the duration of if/when an inflation penalty could exist. Furthermore, any future pricing and contracting strategies can impact this price as much if not more severely than what is currently established.

Do a complete analysis of all data you have collected.

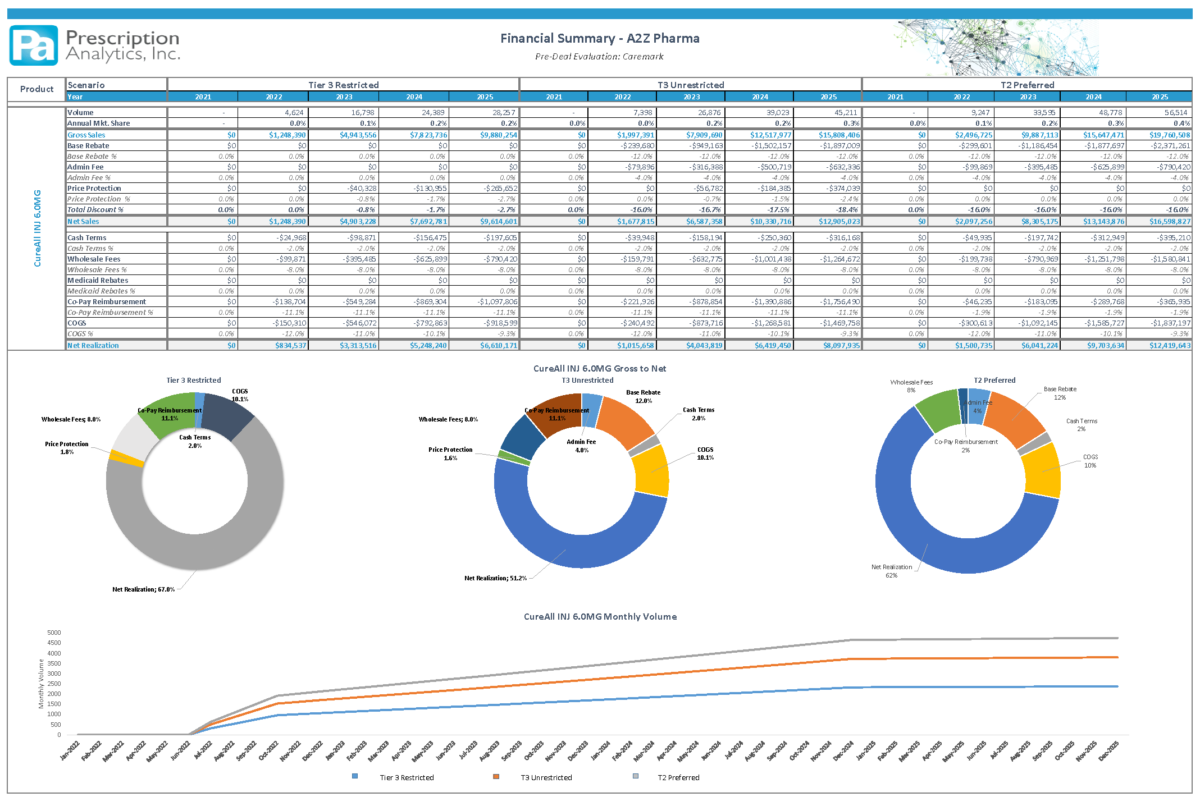

Understanding the current and targeted customer base and associated pricing will determine a successful launch. Modeling the product sales and completing a current Gross to Net analysis before launch while incorporating proposed contract changes and impacts described above is necessary to incorporate the ideal launch strategy. (See: Financial Summary – A2Z Pharma)

Finalize your plan and make any necessary organizational changes that will allow you to successfully execute your product launch.

Once you’ve completed your analyses, assuming the results are positive and you have decided to move forward with acquiring and launching the product, be sure to build out a detailed plan that includes the types of resources required. Be sure to gather a cross-functional team. Expertise in all of the professional disciplines is critical to the success of any product launch and even more crucial when an acquired product comes with a history that must be understood, evaluated and planned for in a way that removes as many shortcomings as possible. Every organization is structured a bit differently, but be sure to include key players from Finance, Sales, Operations, Regulatory, and Government Pricing. Give some careful thought to bringing in outside resources to augment your internal team. Think in terms of how realistic it is to re-purpose internal staff and determine if your organization is better off having them staying focused on operating the business, doing the things that are key to daily existence. Given the significant investment a company makes in a new or newly acquired product, it will oftentimes be well worth contracting for some expertise through an outsourced expert resource.

A minimal checklist of some of the key deliverables contained in an evaluation and commercialization plan include but are not limited to:

- Comprehensive historic evaluation

- Existing contract terms

- Pricing Analytics

- Sales Data

- Gross to Net Calculations

- Determination of whether ANDA or NDA previously subject to a CMS MDRP Agreement (see our white paper on Baseline AMPs Here)

- FDA Approvals and Data Compendia Submissions

- Secure updated NDC

- Labeling/Packaging Design

- ANDA/NDA Approval Letter

- Package Inserts

- Data Bank Submissions

- Warehousing and Distribution

- Product Storage and Handling Requirements

- Non-Title vs. Title Model

- Specialty Distribution Requirements

- Distribution Locations and Effects on Shipping and Handling Costs

- Pharmaceutical LicensingThis is an important consideration if you have not previously marketed a product because the time to complete a full slate of the state and federal licenses required can be extensive.

- State License Requirements

- Controlled Substance License Requirements

- Designated Representative Identification and Requirements

- Registered Agent(s) Identification

- Secretary of State Registrations

- Manufacturing/Distribution SOPs

- Financial Management

- Order to Cash and Chargeback Processing

- Order Management and Fulfillment

- Cash Application and Deduction Substantiation

- Month-end Financial Reporting and Closing Documents

- Reconciliation and Disputes of Chargeback Data

- Reporting, Oversight and Audit Requirements

- Sales and Marketing

- Recruiting, re-purposing, training sellers on key features of the new product

- Notification to the distribution channel of the impending availability of the product

- Negotiation of contracts

- Sales Operations/Market Access Support

- Pricing/Contract Management

- Rebate Liability Accruals

- Sales Reporting

- Conducting Market Analysis

- Demand Forecasting and Supply Chain Management

- Gross to Net Calculations

- Procedure Development and ongoing management

- Government Pricing and Reporting

- Securing/Novating Government Contracts

- Regulatory requirements and legislative update integration

- Managing rebate reconciliations and payments

- Associated analytics, computations and submissions

- Commercial, Retail and Wholesale Contract Management

- Centralized storage for contract terms and conditions

- Connectivity to data portals and exchanges

- Invoice reconciliation and payment processing

- Contract analytics and reporting

- State and Federal Price Reporting and Financial Disclosures

- Regulatory updates and reporting requirements

- Mandatory report submissions and required deadlines

- Organizational visibility into reporting triggers

Implement and manage the plan. Adapt if necessary.

Gathering the right resources and investing the time in creating a complete analysis of a potential product acquisition and subsequent launch, along with building a detailed commercialization plan for your new product, will go a long way toward ensuring success—assuming all of the analytics are positive for a go to launch. Be sure every aspect of your plan has specific deliverables, deadlines and accountable individuals, and assign a project manager with executive level access to ensure that all resources are accomplishing their key deliverables on a timely basis.

Jeremy LaJoice

Chief Compliance Officer

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy