Chargeback Processing — Best Practices to Avoid Revenue Leakage & Risk

Chargeback processing, validation, and reconciliation are integral in maintaining a profitable business in the highly competitive U.S. pharmaceutical market. Profit margins are tight, especially for generic drug manufacturers, where it is typical to operate with a profit margin of less than 5%. Cash flows can be even tighter. Chargebacks are often viewed as a mundane, automated process, however, seemingly simple errors in a single contract or pricing value within your chargeback process can have catastrophic financial and compliance effects across your business. Accounts receivable, rebate payments, and government pricing could all be adversely affected.

With expertise and support of more than 50 labelers in government pricing and compliance, we often identify and/or help resolve downstream negative impacts from chargeback processing errors. This paper will outline critical factors to look for and consider when selecting a chargeback partner or establishing your internal processes to minimize your revenue leakage and risk.

A good process and system will validate chargebacks on multiple levels (such as contract price, product, contract ID, member ID and effective dates) with precision, discipline, and regularity. As a pharma manufacturer continues to grow and add more products and contracts, the complexity of ensuring the accuracy of chargeback claims multiplies exponentially. It’s common for a generic manufacturer to grow to 100+ NDCs across 50+ contracts, each with different and oftentimes complex pricing, terms and effective dates all requiring highly disciplined management and oversight. These manufacturers can expect to receive hundreds of thousands of chargeback line items in a single month. If at any point during the month a validation is failed or an incorrect claim goes unnoticed, this effect can be detrimental. Oftentimes, these errors continue on multiple claims for several weeks or even months, wreaking havoc on profit margins.

Let’s review a typical scenario for chargeback processing to highlight where we often see errors and what the potential risk can be.

SCENARIO:

Product A is a 100-count bottle of tablets sold to a Walgreens Pharmacy under a Walgreens contract. The WAC price of Product A is $45, and the Walgreens contract price is $15. The pharma manufacturer sells product A to AmerisourceBergen, the wholesaler, at $45 and they in turn generate a $30 chargeback for each bottle that Walgreens stores purchase across the country. This is a high-volume product for Walgreens, and they purchase 50,000 bottles per month for all their stores. AmerisourceBergen (ABC) receives a 2% cash discount off the WAC price for prompt payment to the manufacturer. Additionally, ABC receives a 12% service fee off the contract price for each bottle shipped to a Walgreens store. Finally, Walgreens receives a 9% rebate under their Group Purchasing Agreement from the manufacturer.

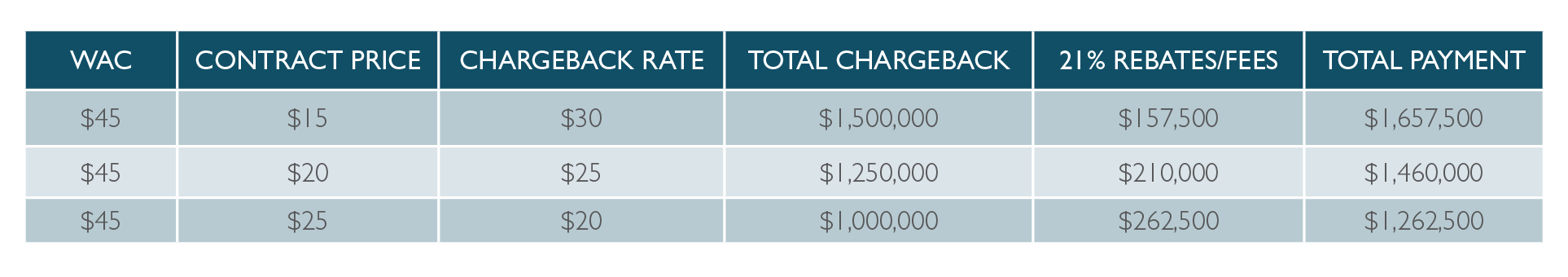

The chart below is a summary of key data points from this example that we will reference to highlight the significant financial risk and impact chargeback processing errors can have when submitted at different price points:

RISK & IMPACT ANALYSIS:

Here are common errors we observe in which a single validation point can have a significant negative financial impact.

- The chargeback line could have the incorrect WAC, say $55 instead of $45. This means ABC could potentially now claim a 2% cash discount off $55 ($1.10 per bottle) vs the 2% off $45 ($0.90 per bottle) it should be. This $0.20 difference per bottle would result in a $10,000 over charge per month based on the volume.

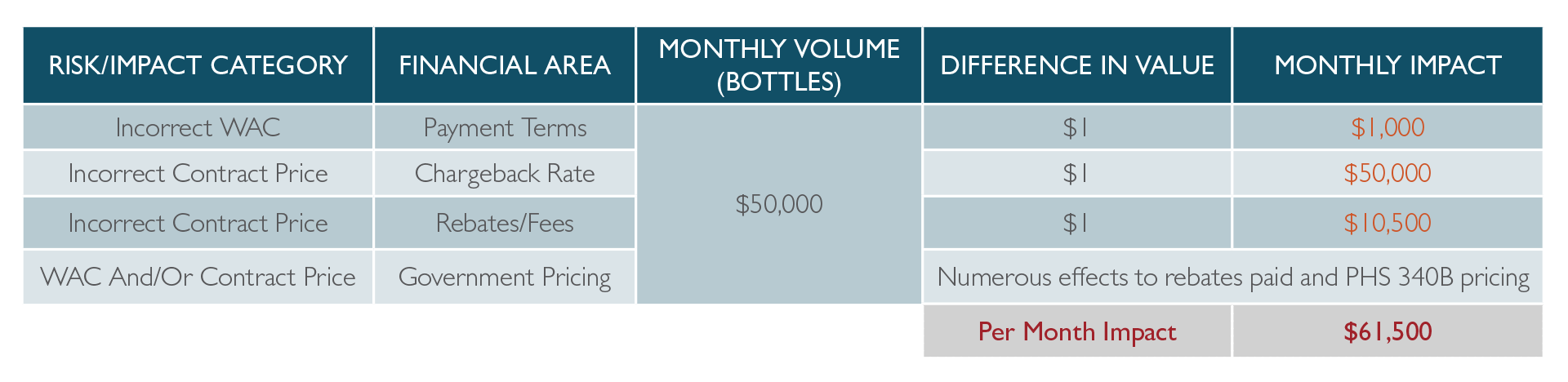

- Another issue could be an incorrect contract price. If ABC has a $14 contract price loaded in place of the $15, this $1 difference would lead to $50,000 additional chargeback dollars claimed per month. Incorrect contract pricing also has varying effects on the total fees/rebates paid to both ABC and Walgreens as shown in the table below.

- Large purchasers, such as ABC and/or Walgreens, have multiple departments for invoicing, chargeback processing and fees. For example, there could be a billing error outside of the chargeback area where the rates are incorrect for rebates/fees. Referencing the $15 contract price in the examples above, if ABC uses $16, this additional $1 equates to an extra $10,500 in total fees/rebates paid per month at the 21% rate. All components of the order to cash cycle must be validated as contract pricing, since a fully mature supplier can change pricing daily across an entire portfolio of products subject to a multitude of contracts.

- Government Pricing is dependent on accurate data from chargebacks and rebates to determine a pharma manufacturer’s Medicaid rebate liability. Specifically, the Average Manufacturer Price (AMP) applies chargebacks and rebates within the calculation based on the Class of Trade (COT) for each purchasing member of each chargeback contract. If the COT is not correctly assigned in the chargeback system, this will change the AMP and, more importantly, the compliance within the program. Not only are COT assignments important for accuracy and compliance, but the chargeback and rebate rates will change the output of the calculation. Based on the table above, an incorrect chargeback rate could result in nearly $500,000 less of these discounts being applied, thereby potentially inflating the AMP as a result. A higher AMP means increased Medicaid rebate liability.

Each example above illustrates the importance of disciplined management and accuracy in chargeback processing. Incorrect claims will quickly erode the already slim profit margins of an organization. It will also directly affect accrual rates and cash application. The Accounts Receivable Team will have trouble substantiating deductions if the totals do not align. The subsequent additional collection efforts will increase labor costs as well.

The table below summarizes a simple $1 effect to pricing and the total monthly impact that results. The government pricing impacts would need to be quantified and assessed separately based on volumes going to that sector. In certain cases, it could be favorable to a pharmaceutical supplier, however, the data would be incorrect and expose potential fines and penalties either way.

CHARGEBACK PROCESSING BEST PRACTICES:

Chargeback validation will never be 100% accurate without proper management, expertise, and strict adherence to best practices. Successful pharmaceutical companies employ the following strategies to effectively manage the complexities of chargebacks and mitigate risk:

- Create & implement a disciplined process for maintaining and loading all contracts, pricing and changes that ensure all departments and individuals are accountable for all updates

- The Sales Team should effectively communicate any new contract, product addition or price change to Internal and Chargeback Management teams

- Contracts and Pricing Teams should load all products and contracts with the correct pricing and effective dates and have access to a database or chargeback system to easily view and report. This information must then be submitted to the wholesaler(s) and archived with a date stamp to extract in the event of a submission error.

- Finance Teams need to understand what accrual rates should be set based on new and changing contracts. Additionally, they should understand any associated fees/rebates that will result so those can be accounted for and validated and paid/disputed if necessary.

- Supply Chain Teams may need to ramp up production if the volume demand increases

- The Customer Service Team needs to invoice the correct WAC pricing and understand the importance of inventory and product allocations

- Any error in a chargeback should be responded to by the submitting wholesaler and other impacted parties immediately. This error will most likely continue until it is resolved. Each day the effect multiplies and the chances of getting anything paid back or resubmitted begins to diminish.

- It is important to know the correct department and even have a go-to person to help escalate the error correction

- Errors in chargebacks should be reported to internal finance partners so they are aware of any waterfall effect as mentioned above

- Accounts Receivable should work with the Chargeback Processing Team to ensure any incorrect deductions are paid back

- Nurture the relationship between trading partners. The Big Three wholesalers (ABC, Cardinal Health and McKesson) are always willing to host an on-site meeting. This could be a chance to address an issue or just put a face to a name. That personal touch can go a long way in efficiency and priority when issues arise.

- Understand the timing of wholesaler submissions. If, for example, McKesson sends chargeback files three times per week and only one file has been sent for the week, reach out to your contact. Wholesalers are very good at following a historical cadence, so chances are there was a file transfer error somewhere.

- Review and audit the data. Depending on the volume, a review by contract and product could be weekly or monthly. If there is a large deviation from history, there should be an associated change (e.g. a new contract, product addition or a lost award). It is also good practice to review the chargeback rate against total sales to understand how that changes by wholesaler, as well as making sure it is not over 100%.

Dan Piergies

Chief Analytics Officer

Prescription Analytics is a leading provider of turnkey services for pharmaceutical manufacturers in government pricing, rebate processing, licensing, state transparency reporting, chargeback processing, and commercial operations support. If you are interested in learning more about how we help companies like yours achieve their growth, compliance, and profitability objectives, contact us today.

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy