How to Calculate A Unit Rebate Amount

For people who regularly work in the pharmaceutical industry within the government pricing space, the question of how a URA is calculated may be one easily answered. For even the most seasoned pharma executives not exposed to government pricing on a regular basis, this question, much less the acronym URA, can be quite foreign. This clarifies what a URA is and how it’s calculated.

WHAT IS A URA?

URA stands for “Unit Rebate Amount” and is associated with the Medicaid Drug Rebate Program.

Drug manufacturers participating in the Medicaid Drug Rebate Program must complete and report monthly and quarterly “AMP Calculations” (Average Manufacturer Price calculations). The process aims to calculate the average price paid by a retail pharmacy for a given drug.

Pharmaceutical drug manufacturers will owe rebates to the over 300 Medicaid programs in various states, based upon the URAs derived from these AMP calculations and the utilization driven through the various programs. The intent here is that manufacturers are paying the agreed upon rebate rates, based upon what the drug is being acquired for by the pharmacies, as the pharmacies are the entities seeking reimbursement from Medicaid when Medicaid beneficiaries have their prescriptions filled.

HOW IS A URA CALCULATED?

As the intent is to provide those not entirely familiar with the process of calculating an URA, we’ve left out line extension scenarios to avoid potential confusion. If you have no idea what I’m talking about, no worries! Call us on that subject later for further clarification.

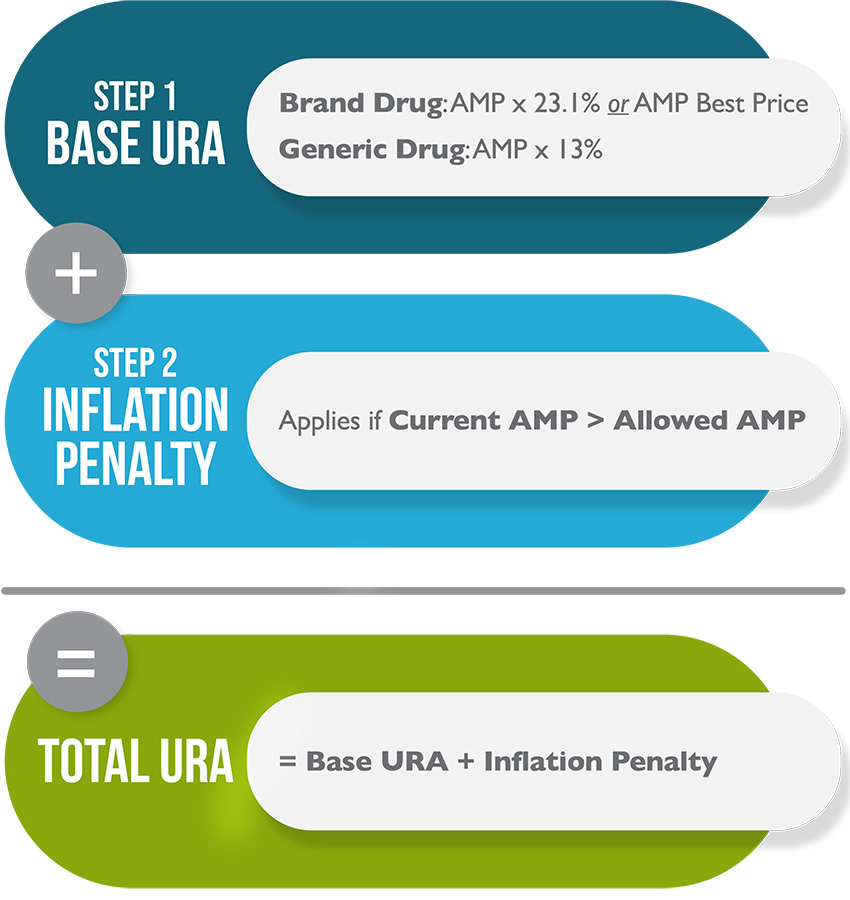

STEP 1:

For both brand and generic products, URAs can be calculated once the quarterly AMP has been completed. The calculations for brand and generic products vary from that point forward.

Brand drugs follow a URA calculation that starts with taking the quarterly AMP calculation multiplied by 23.1% to come up with the Base URA. From there, we look at the difference between AMP and Best Price. Best Price is essentially the lowest price offered during the quarter for that specific product. If the difference between AMP and Best Price is greater than the value of AMP multiplied by 23.1%, then AMP minus Best Price will serve as the Base URA calculation. This is essentially ensuring that the government is receiving equal or better pricing than retail/commercial customers.

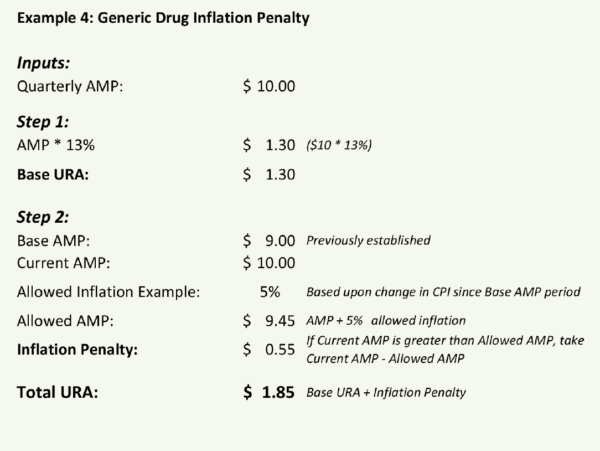

Generic drugs follow a URA calculation that begins with taking the quarterly AMP calculation multiplied by 13% to come up with the Base URA. There are no Best Price reporting requirements for generic drugs and therefore no secondary Best Price comparison as there is with the brand calculation.

STEP 2:

Once the Base URA is calculated, both brand and generic drugs can be subject to Inflationary Penalties if the AMP has increased faster than the rate of inflation, using the Consumer Price Index. These Inflationary Penalties were designed to serve as price protection for the government to help ensure that a drug currently being used by government programs doesn’t increase in price drastically in a short timeframe.

EXAMPLES

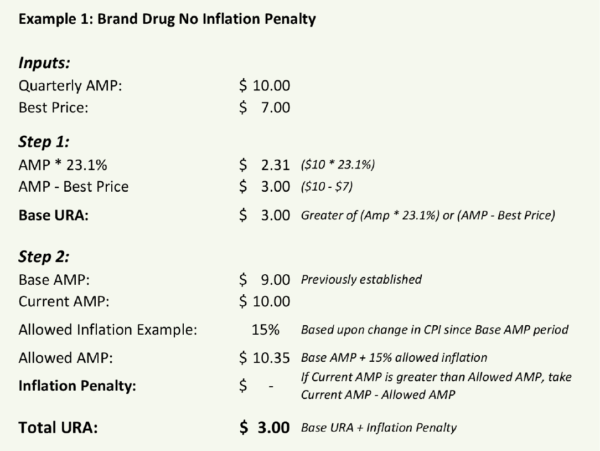

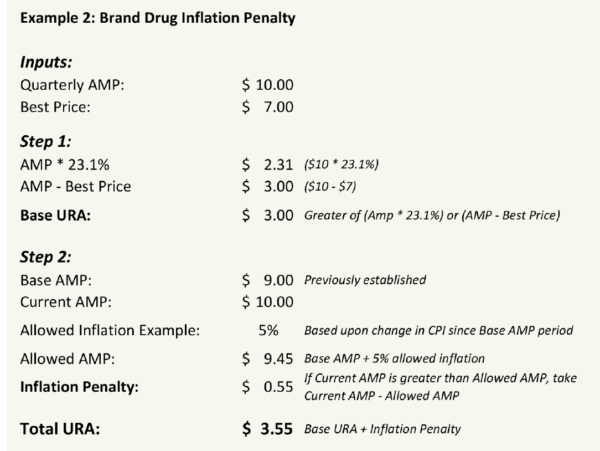

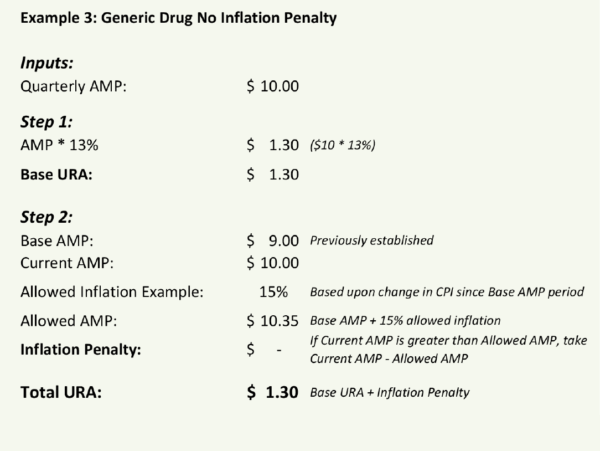

Below are four examples that walk through the calculations for brand and generic manufacturers:

BRAND PRODUCT EXAMPLES:

GENERIC PRODUCT EXAMPLES:

SUMMARY

Understanding the inputs to accurately calculate URAs is an important process for any prescription drug manufacturer. The risk in getting it wrong can mean overpaying Medicaid Drug Rebate Program liabilities or underpaying, which puts a drug manufacturer at risk of noncompliance with CMS. Make sure you have a knowledgeable team or partner to support this critical calculation.

Jeremy LaJoice

Chief Compliance Officer

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy