Key Terms in Pharmaceutical Government Pricing

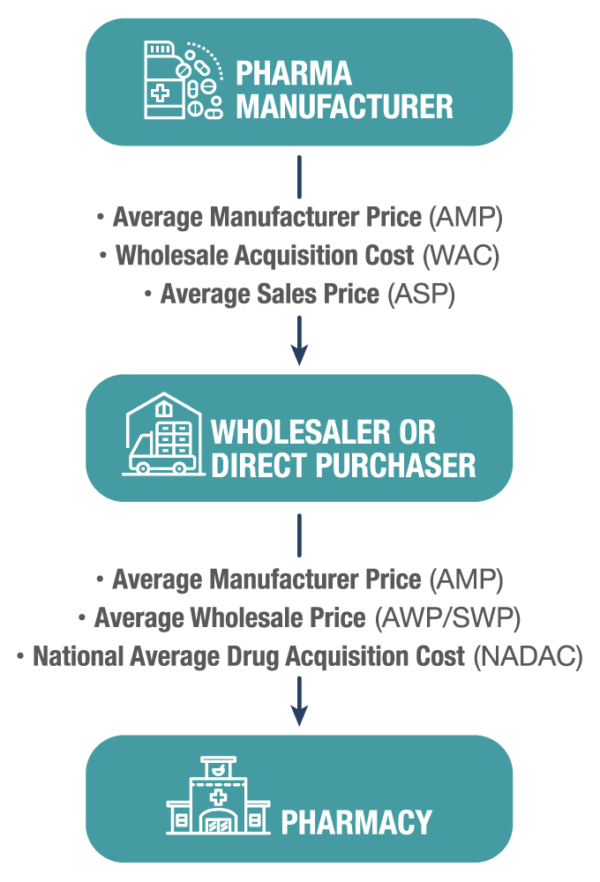

Pharmaceutical pricing can be a challenge to understand and a difficult landscape to navigate. There are multiple prices set for each individual National Drug Code (NDC) – some publicly available and some not. WAC, ASP, AWP, and AMP are some terms you may have heard of, but what exactly do they mean and at what price point do various customers actually purchase?

The answer to that question largely depends on who is selling and who is purchasing the drug.

Drug pricing changes dramatically through the supply chain. Some of the terms you hear about aren’t prices at all, but rather calculated values that are submitted to various government entities and represent a weighted average of pricing a manufacturer receives for the drug.

Below you will find common pharma industry terms you likely come across in the pharma industry and what exactly they represent.

WAC (Wholesaler Acquisition Cost)

WAC is the price paid by a wholesaler for drugs purchased from the wholesaler’s supplier, typically the manufacturer of the drug. On financial statements, the total of these amounts equals the wholesaler’s cost of goods sold. Publicly disclosed or listed WAC amounts often do not reflect all available discounts. In a real-world example, this is the price that a manufacturer would use to sell a drug to a large wholesaler such as ABC, Cardinal, or McKesson. While this is the price a wholesaler pays to acquire a drug, it is almost always higher than the price that the end customer or pharmacy pays the wholesaler for the drug, especially when it comes to generic drugs.

AWP (Average Wholesale Price) and SWP (Suggested Wholesale Price)

Average Wholesale Price and Suggested Wholesale Price are often used interchangeably but represent the same value. The AWP or SWP of a drug is the average price that a wholesaler charges a pharmacy when the pharmacy purchases a drug. The unique part of SWP is that it is set by the manufacturer, typically as WAC plus 20%. This is more of a “suggested price” as most wholesalers sell to pharmacies significantly below the SWP level, or at contract prices negotiated by the pharmacies directly with the manufacturer. SWP can also be used to determine third-party reimbursement within the health care industry. Reimbursement amounts are typically determined as a percentage of SWP.

Due to the sensitive nature of reimbursement rates this value has been under scrutiny and litigation, resulting in preference for the term SWP over AWP.

NADAC (National Average Drug Acquisition Cost)

NADAC is a value that is based on the retail price survey and focuses on retail pharmacy acquisition costs. NADAC represents the invoice price retail pharmacies pay for medications and is collected via surveys administered by CMS (Centers for Medicare and Medicaid Services) and is updated on a weekly basis.

AMP (Average Manufacturer Price)

AMP is a calculated value that all manufacturers participating in the Medicaid Drug Rebate Program must report to CMS on a monthly and quarterly basis. AMP is not a price that is set by a manufacturer or any customer but represents the average price the manufacturer receives for a drug that is sold direct to a retail pharmacy or a wholesaler distributing to a retail pharmacy indirectly, net of all eligible discounts. AMP is used to derive various government pricing values such as Medicaid Unit Rebate Amounts (URA) and PHS/340b pricing. AMP was developed to be reflective of the actual market price for a drug and is typically much lower than the WAC and SWP.

ASP (Average Sales Price)

ASP is a calculated value that all manufacturers must report for drugs that are covered under Medicare Part B (typically physician-administered drugs and injectables). Similar to AMP, ASP is calculated on a quarterly basis and is reported to CMS. ASP is a weighted average of sales – net of all eligible discounts – to all customers exclusive of sales to government entities or non-US entities. ASP is used by Medicare to determine reimbursement to healthcare providers administering drugs covered under Medicare Part B. That rate is set at 106% of the weighted average ASP.

Non-FAMP (Non-Federal Average Manufacturer Price)

Non-FAMP is a calculated value that covered drug manufacturers (i.e. brand manufacturers) must report to the VA on a quarterly basis. The non-FAMP is the average price paid by wholesalers for drugs distributed to non-federal purchasers. This calculated price should account for any rebates, cash discounts or other price reductions while excluding any discounts given to federal purchasers.

FCP (Federal Ceiling Price)

FCP is a calculated price that is derived by the manufacturers for drugs listed on the Federal Supply Schedule (drugs offered at discounted pricing to Veterans Affairs, Department of Defense, Public Health Service, US Coast Guard, and other federal government agencies). FCP represents the maximum price that manufacturers can charge for FSS-listed brand drugs or Covered Drugs as defined by the VA.

URA (Unit Rebate Amount)

URA (Unit Rebate Amount) is a value that drives the rebates a pharmaceutical manufacturer will owe to various state Medicaid rebate programs when their prescription drug is dispensed through the MDRP (Medicaid Drug Rebate Program). All manufacturers that want their products covered under Medicaid must enter into a rebate agreement with regulatory bodies and promptly pay rebates to state programs to stay in compliance with CMS.

For additional information on how to calculate a URA, click here.

AO (Avoid Obfuscation)

Avoiding obfuscation, or more plainly, avoiding confusion, is something we’re here to help you do. Government pricing can be difficult to understand. Getting to know the terminology can help. If you’d like to know more about how we can help you not only avoid confusion, but also mitigate the financials risks associated inaccurate computations, call us anytime.

Bob Devenport

Vice President of Government Pricing

Subscribe to receive our publications.

By signing up, you are agreeing with our privacy policy